- #How to record expenses in quickbooks how to

- #How to record expenses in quickbooks update

- #How to record expenses in quickbooks download

- #How to record expenses in quickbooks free

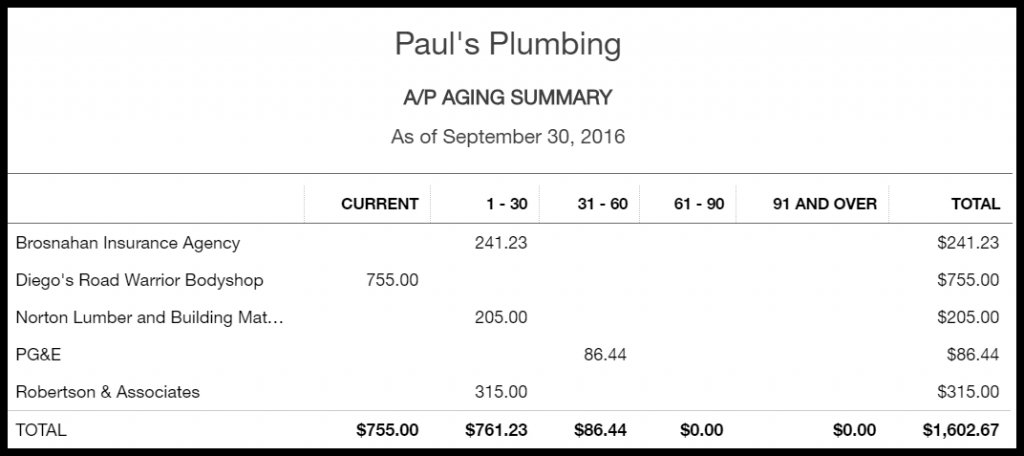

In the example we just went through, attaching a photo of the receipt was the last thing we did to record an expense in QuickBooks Online. It will also show up in the Expenses by Vendor Summary and Unbilled Charges reports, among others.

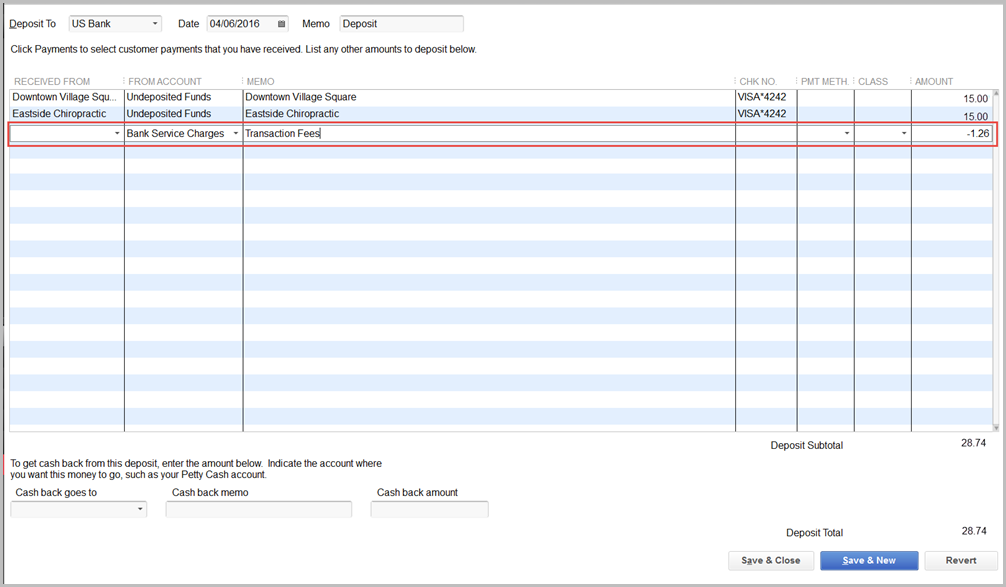

Your record of the lunch will now appear on the Expense Transactions screen. Add a Memo to remind yourself of the reason for the lunch (very important!) and attach a photo of the receipt if you take one. Since you’re going to bill this to the customer as a part of your project fee, click in the Billable box to create a checkmark. You can attach a picture of a receipt if you’d like QuickBooks Online allows you to thoroughly document expenses. You can attach a picture of a receipt if you’d like. Under Category details, select the correct category from the drop-down list and enter a Description and Amount. Fill in the fields at the top of the screen with details like Payee, Payment date, and any Tags you want to specify. Click the down arrow in the New transaction button and select Expense. Hover over Expenses in the navigation toolbar and click on Expenses. You still have to enter it as an expense on the site so that when your credit card statement comes, you can match the credit card transaction to the expense you recorded. You charged it to your company credit card, which you track in QuickBooks Online. Let’s say you just had lunch with a vendor to discuss some products you’re planning to buy for a project you’re doing for a customer. Or you can snap a photo with your phone using the QuickBooks Online mobile app to document the money spent. You can create a record on the site itself. QuickBooks Online provides two ways to enter expenses. And two, you never know how an extra $42.21 under Meals and Entertainment might affect your income taxes. When you disregard even small expenses, you can have two problems. Or you pick up a ream of printing paper and a cartridge at the office supply store and neglect to record the purchase. You figure it’s not that much money, anyway. It’s easy to go out to lunch with a client and forget to save the receipt. But are you as careful about your purchases? You record payments as soon as they come in and deposit them in your company’s bank account.

You undoubtedly keep a very close watch on the money coming into your business.

#How to record expenses in quickbooks how to

Here’s how to record expenses in QuickBooks Online and on your phone. The money you spend to run your business must be recorded conscientiously for your taxes and reports.

#How to record expenses in quickbooks free

#How to record expenses in quickbooks download

#How to record expenses in quickbooks update

0 kommentar(er)

0 kommentar(er)